The Evolution of Western Industrial Policy From Climate Goals to Geopolitical Strategy: Is the EU Bucking The Trend?

ZEITGEIST SERIES BRIEFING #70

ZEITGEIST SERIES BRIEFING #70

In recent years, industrial policy in Western nations has shifted significantly. Originally driven by the push for a low-carbon economy, these policies are now increasingly shaped by national security and geopolitical concerns. This change is reflected not only in the motivations behind policy decisions but also in the tools used to implement them.

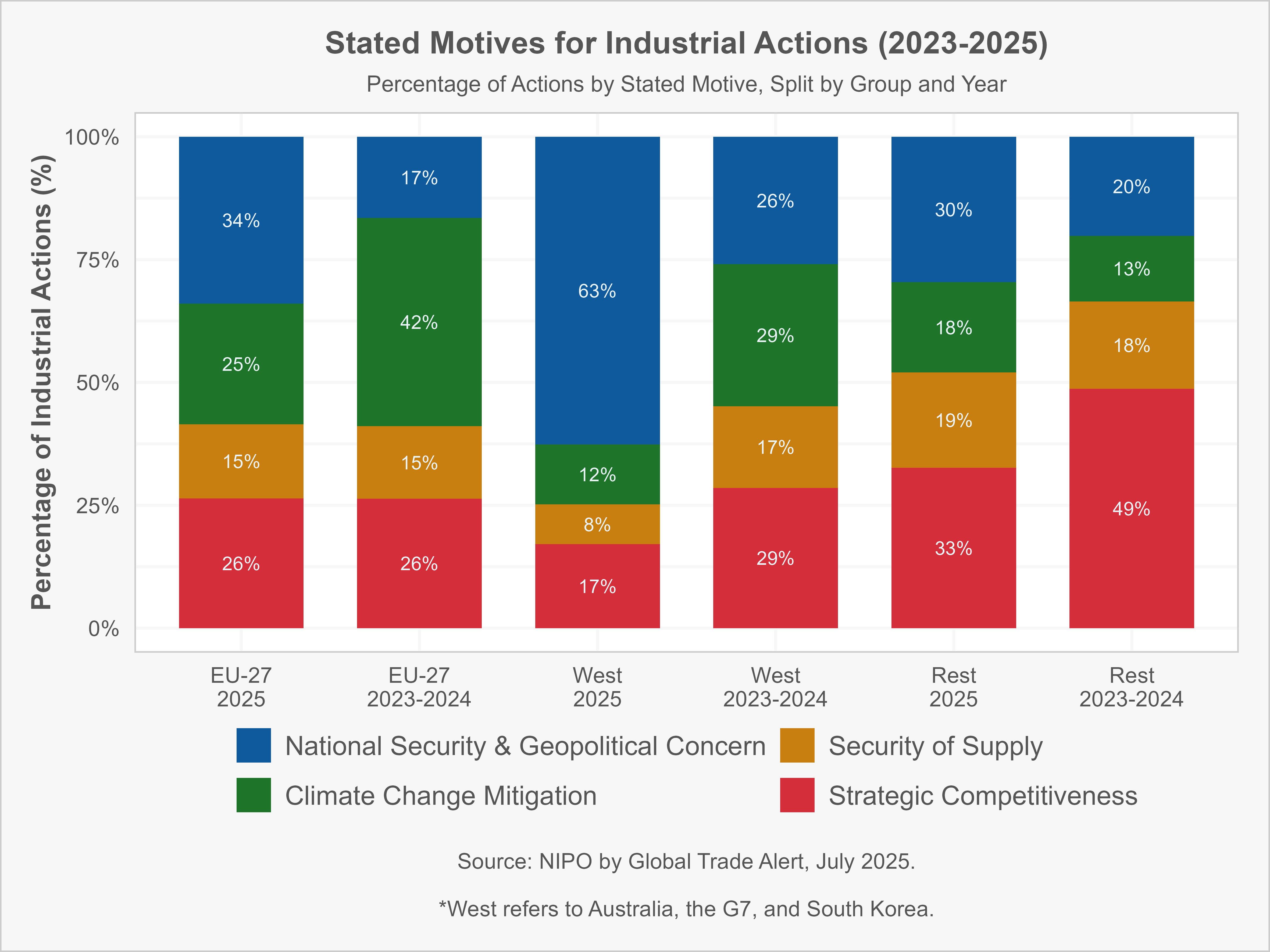

As shown in Figure 1, the percentage of industrial policy actions in G7 countries, South Korea, and Australia citing security or geopolitical reasons increased sharply from 26% in 2023–2024 to 63% in 2025. In contrast, climate-related justifications dropped from 29% to 12%, indicating a pivot away from environmental priorities.

The U.S. exemplifies this trend: elements of the Inflation Reduction Act (IRA), once promoted as a green initiative, are now interpreted through a national security lens. Tax incentives are increasingly designed to exclude Chinese components, especially in battery supply chains.

The EU, however, has diverged. While the share of policies citing security motives rose from 17% to 34%, climate mitigation remains central. The Green Deal Industrial Plan and Net-Zero Industry Act are still framed as decarbonisation strategies, with climate rationales falling in frequency from a higher base: from 42% to 25%.

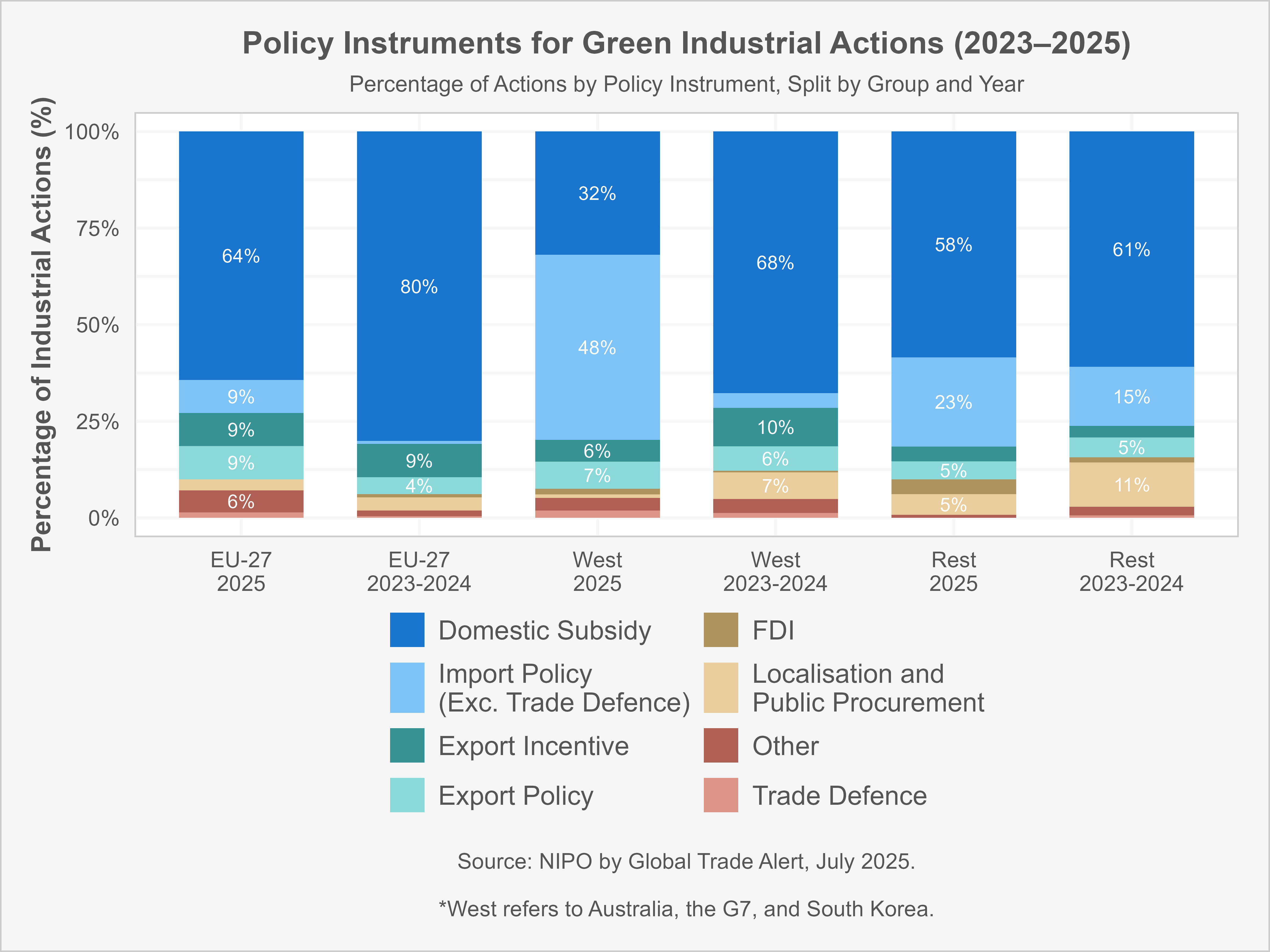

A parallel shift is occurring in policy instruments. Figure 2 shows that, in the West, traditional subsidies for green technologies—such as EVs, hydrogen, solar, and wind—are being replaced by trade restrictions.

Data from the New Industrial Policy Observatory (NIPO) shows that subsidies fell from 68% of green industrial measures in 2023–2024 to 32% in 2025. Meanwhile, import barriers surged from under 4% to 48%.

The U.S. has led this shift, imposing steep tariffs on solar panels and EVs, framing these as tools for strategic autonomy rather than environmental policy. The UK has designated steel as a security-critical industry. In contrast, the EU continues to favour subsidies: 64% of its green policy actions in 2025 were still subsidy-based, down from 80% but well above the Western average.

Between 2023 and 2025, industrial policy in the West experienced a transformation—geopolitical and security concerns overtook climate goals, and coercive trade tools began to supplant traditional subsidies. The EU, while not immune to these trends, has been more cautious. Though the share of its industrial actions citing national security rose, it remains significantly lower than in the broader West. The European Commission and Member States continue to prioritise decarbonisation often, with subsidy-heavy instruments like the Green Deal Industrial Plan and the Net-Zero Industry Act in the vanguard.

Faced with a perfect storm of competing demands from European stakeholders, signs of hesitation are emerging. The EU is thus at a crossroads: will it continue to anchor its industrial strategy in the low-carbon transition and green subsidisation, or align more aggressively with the emerging geopolitically-driven model embraced by its allies?

Fernando Martín is an Associate Director at Global Trade Alert leading the Analytics team.